How Singapore's Increasing GST Impacts Businesses: Strategies for Adapting to Change

Goods and Services Tax (GST) is a tax that is levied on the consumption of goods and services by various countries worldwide. In Singapore, GST was first implemented on April 1, 1994, at a rate of 3%. Since then, the rate has increased, and the scope of GST has expanded. It is a significant source of government revenue and contributes to the country's development and growth. GST is an indirect tax, meaning it is paid by consumers at the point of sale, but it is collected and remitted to the government by businesses.

Recently, Singapore has announced its first increase in Goods and Services Tax (GST) in 15 years, which will bring about significant changes to the country's tax policy. The increase will be implemented in two phases, with the current rate of 7% increasing to 8% in January 2023, and then to 9% in January 2024. This means that consumers will be required to pay an additional 8% or 9% on top of the price of goods and services.

This move is significant as it will impact both consumers and businesses. While consumers will have to pay more for goods and services, businesses will have to navigate changes in tax policy, which may impact their revenue and profitability. Therefore, it is essential for businesses to be prepared and adapt to the changes brought about by the increase in GST.

Why is Singapore Raising the GST Rate?

Over the years, the Singaporean government's annual expenditure has increased significantly, with social spending being the largest portion. The government has been prioritising areas such as healthcare, education, and security to provide better living conditions for Singaporeans. Between 2007 and 2019, government spending has surged from S$33 billion to S$75 billion per year, with healthcare spending alone rising from S$2.2 billion to S$11.3 billion in the same period.

The increase in social spending, particularly healthcare, is attributed to the rapidly ageing population of Singapore. It is projected that nearly one in four citizens will be aged 65 and above by 2030. The government must prepare for future healthcare costs by building more hospitals and clinics, as well as offering medication subsidies to the elderly. The government is also committed to providing its citizens with high-quality education and ensuring public safety and security.

Raising the GST will enable the government to fund these important public services and investments. It will also ensure that Singapore remains a competitive and attractive place to do business, as it will help to maintain the country's stable fiscal position.

The government's decision to raise the GST is aimed at supporting the increasing public spending on social welfare programs such as healthcare, education, and security. The GST increase will provide a more sustainable source of revenue to fund these initiatives, and Singaporeans will ultimately benefit from the enhanced public services.

Furthermore, to manage the impact of the GST increase, the government has decided to absorb GST for publicly subsidised healthcare and education. This means that these essential services will not be affected by the GST increase, and Singaporeans will continue to receive quality healthcare and education without having to bear additional costs.

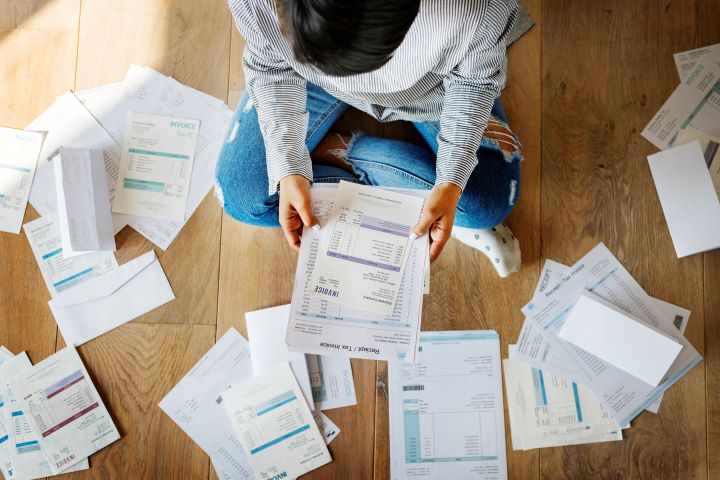

Checklist that businesses need to do for the GST hike to 9% in 2024

As we forge on ahead towards that inevitable day that the 9% comes into effect, here are a few things that you can put on your checklist to optimise your business for the coming year.

Change price displays & Inform customers of the hike

Businesses should ensure that all public price displays such as price tags, price lists, advertisements, and company websites state the new prices inclusive of the GST rate increase.

Businesses can inform their customers of the GST rate hike through their website, social media accounts, or other advertising channels.

Update accounting and invoicing system & Update POS billing systems

Next, businesses need to update their accounting and invoicing systems to reflect the new GST rate. They should also update their Point of Sale (POS) billing systems so that all receipts issued to customers reflect the new GST rate.

Review contracts/agreements with vendors/suppliers/partners

Businesses need to update all documents to include the new GST rate.

Train staff about the planned hike

All employees working in the business should be made aware of the GST rates and transitional rules to apply the correct rate for any sales transactions or reverse charge supplies.

Apply for Major Exporter Scheme (MES)

Businesses that import and export goods substantially can apply for the MES to ease cash flow. Under the MES, they will be able to import non-dutiable goods with the GST tax suspended.

It is important to note that the Committee Against Profiteering (CAP) takes a serious view of any unjustified price increases and will investigate all feedback received. Therefore, businesses need to be cautious and ensure that they do not use the GST rate increase as an excuse to raise prices. IRAS has also provided a guide with price-display requirements.

Implication & Impact on Business Owners

With the increase in GST, businesses will need to pay more for goods and services that they purchase. For example, a business that purchases raw materials for $1000 will have to pay an additional $70 in GST (assuming a GST rate of 7%). As a result, businesses will face higher business costs and lower profit margins. This could be particularly challenging for new businesses that have yet to establish themselves in the market.

Higher business costs

With the increase in GST, businesses will need to pay more for goods and services that they purchase, as well as for GST on their own sales. This could lead to higher business costs and lower profit margins for new businesses.

Price increases

As a result of higher business costs, businesses may need to raise their prices in order to maintain their profit margins. For example, a retail store that sells goods at $100 may need to increase their prices to $107 (assuming a GST rate of 7%) in order to cover the additional cost of GST. This could lead to higher prices for consumers and could make it more difficult for new businesses to compete with established players in the market.

Changes in consumer behaviour

Higher prices and changes in the cost of living could lead to changes in consumer behaviour. Consumers may choose to cut back on spending, switch to cheaper alternatives, or reduce their consumption of certain goods and services. For example, if the price of food increases due to the GST rate hike, consumers may choose to eat out less often or switch to cheaper restaurants. Higher prices may lead to a reduction in demand for goods and services, which could, in turn, affect a company's revenue.

Compliance requirements

New businesses that are required to register for GST will need to comply with GST regulations and submit regular GST returns to IRAS. This could add administrative and compliance costs to their business operations.

For example, a new business that is not familiar with the GST regulations may need to hire an accountant or tax consultant to help them understand the requirements. Businesses need to review their current processes and systems to ensure that they are GST compliant.

Cash flow management

As a registered GST business, new business owners will need to manage their cash flow effectively in order to ensure that they have enough cash on hand to pay their GST liabilities. This could be particularly challenging for new businesses that are still in the process of building up their cash reserves. For example, a new business that is required to pay GST on a quarterly basis may need to set aside a portion of their revenue each month in order to ensure that they have enough cash to pay their GST liabilities. Business owners must ensure that they have sufficient working capital to cope with the increased cost of goods and services. This may require revising budgets, adjusting pricing strategies, and exploring financing options to cover any short-term cash flow gaps.

Strategies for Businesses to Prepare for GST Rate 9% in 2024

As the new GST rate of 9% approaches in 2024, businesses must prepare themselves to adapt to the changes to ensure they continue to operate efficiently and profitably. Here are some strategies businesses can implement to prepare for the new GST rate:

Review your pricing strategy

With the increase in GST, your costs will also increase. Therefore, it is essential to review your pricing strategy to ensure that your margins are still viable. Consider whether you can absorb the additional costs or if you need to pass them on to your customers. Conducting a thorough analysis of your pricing structure can help you make informed decisions and avoid any sudden price hikes that could negatively affect your customer base.

A bakery that sells cakes and pastries may need to review its pricing strategy to ensure that its profit margins remain viable after the GST increase. The bakery may decide to increase its prices slightly to cover the additional costs or absorb the cost to maintain its competitive advantage.

Review your expenses

To offset the impact of the higher GST, you may need to review your expenses and see where you can cut costs. Look for areas where you can save money without compromising the quality of your products or services. For example, you could explore alternative suppliers or renegotiate existing contracts to reduce your expenses. You could also consider implementing energy-efficient technologies to reduce your utility bills or automating certain processes to increase efficiency and reduce labour costs.

A printing company may review its expenses and find that it can reduce its paper consumption by implementing a paperless system, such as using digital forms and signatures. By doing so, the company can reduce its expenses without compromising the quality of its services.

Seek professional advice

GST regulations can be complex and it may be helpful to seek professional advice to ensure that you are fully compliant with the new regulations. Consult with your accountant or tax advisor to ensure that your business is prepared for the changes. They can also help you understand how the increase may affect your specific business and recommend any adjustments or actions to take.

A small accounting firm may seek advice from a tax consultant to ensure that they are fully compliant with the new GST regulations. The consultant may advise the firm to adjust their invoicing procedures to ensure timely and accurate filing of GST returns.

Communicate with your customers and stakeholders

Another important step is to communicate with your customers and stakeholders about the upcoming GST increase and how it may affect them. Informing them in advance and being transparent about any price increases can help maintain trust and avoid any negative reactions.

A retail store may communicate with its customers through a notice on their website, social media or in-store signage about the GST increase and how it may affect prices. This transparency can help maintain customer trust and loyalty.

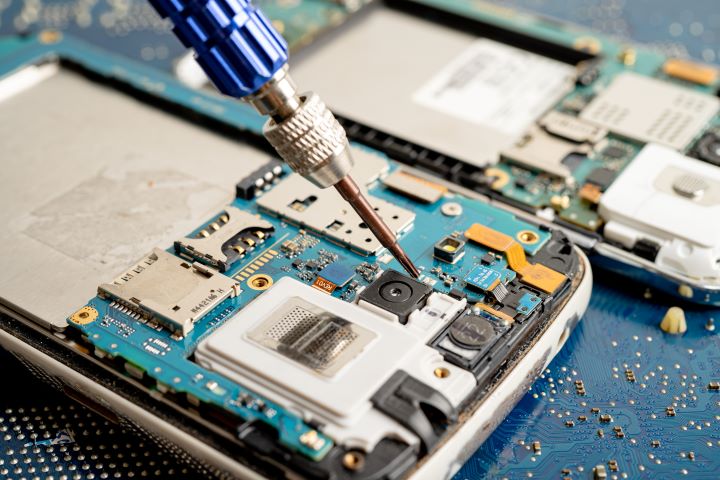

Technology improvement

Finally, consider investing in technology and digital platforms to streamline your operations and improve your business's overall efficiency. By leveraging technology, you can better manage your finances, track expenses, and automate certain processes, freeing up time to focus on growing your business and mitigating the impact of the GST increase.

A logistics company may invest in a new software system to track inventory, shipments, and other operations. This can help the company streamline its processes, reduce human error, and free up time to focus on mitigating the impact of the GST increase.

Closing Words

In conclusion, the increase in GST rates in Singapore will have a significant impact on new business owners. It is crucial for them to understand the implications and take necessary steps to prepare for it in advance. This includes registering for GST, maintaining proper records, and reviewing their pricing strategies.

Ultimately, the success of a business is dependent on its ability to adapt and evolve in response to changes in the market and the economy. The increase in GST rates presents a challenge, but with the right strategies and tools in place, business owners can navigate through it and emerge stronger than before.

In the bigger picture, the increase in GST rates reflects the government's commitment to ensuring a stable and sustainable economy for Singapore. The additional revenue generated can be used to fund critical social programs, such as healthcare, education, and infrastructure development. It also helps to maintain the country's competitive edge in the global marketplace.

In conclusion, the increase in GST rates in Singapore is a significant development that will impact businesses and consumers alike. While there are challenges to be faced, there are also opportunities for growth and development. By taking the necessary steps to prepare and adapt, business owners can position themselves for success in the future. At the same time, we as consumers can play a part in supporting local businesses and contributing to the growth of our economy. Ultimately, the success of our country depends on the cooperation and collaboration of all stakeholders.